Ways To Bank

Ways To Bank Quick Banking

Quick Banking Downloads

Downloads Get in Touch

Get in Touch

Set a savings target

Decide the amount you want to save, along with an expected timeline. For example, if you wish to save ₹1 lakh within a year, your savings target would be ₹8,199 a month, assuming 3% interest on your Savings Account. Having a separate Savings Account for your saved funds would help you track your progress.

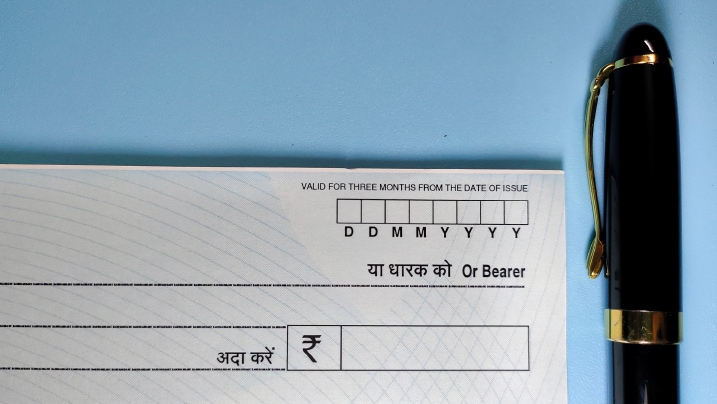

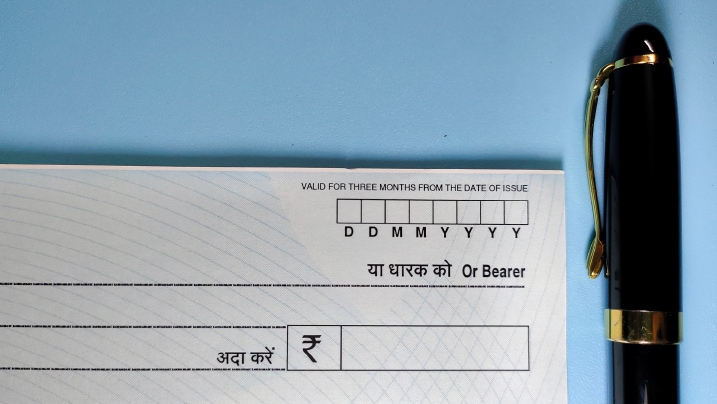

Cheques

Even in the age of digital banking , it continues to be significant in the banking industry. It is used in both small and large transactions. It can be used in various transaction types, from paying an employee to clearing utility bills. This mode of payment is preferred by many as it involves the convenient and secure transfer of funds.

Learning to save money for any future contingencies is one of the best things you can do to ensure that you are able to deal with life's many obstacles. Your savings can give you a sense of strength and security that can help you deal with obstacles and emergencies and enjoy your life to the fullest.

Some quick example text to build on the card title and make up the bulk of the card's content.

Some quick example text to build on the card title and make up the bulk of the card's content.

Some quick example text to build on the card title and make up the bulk of the card's content.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy Lorem Ipsum has been the industry's standard dummy..

What is Fixed Deposit (FD) in bank?

Fixed Deposit is an investment scheme offered by banks and financial institutions that allows depositors to park a lump sum amount with the bank at a pre-determined interest rate for a pre-determined tenure. The interest rate on FDs remains unchanged through the tenure in most cases. As your money lies with a bank or a financial institution, the FDs are a secured mode of investment. Your returns do not fluctuate due to market factors and there is no volatility associated with your investments.

Benefits of Fixed Deposits

Home Loan

A home loan is an amount an individual borrows from a financial institution such as a housing finance company to buy a new or a resale home, construct a home or renovate or extend an existing one. The money is borrowed at a specific interest rate and repaid within a particular duration in smaller instalments known as EMIs (Equated monthly instalments).

Gold Loan

Gold loan (also called loan against gold) is a secured loan taken by the borrower from a lender by pledging their gold articles (within a range of 18-24 carats) as collateral. The loan amount provided is a certain percentage of the gold, typically upto 80%, based on the current market value and quality of gold.

Some quick example text to build on the card title and make up the bulk of the card's content.

Some quick example text to build on the card title and make up the bulk of the card's content.

Some quick example text to build on the card title and make up the bulk of the card's content.

It works like a road sign in a way: it's often a moment when you consider where you stand in life. A milestone can also be a non-individual event that results in a major change, such as a milestone win or a company sales milestone.